Well, we seem to have bottomed out at 4588 on 2nd JAN.The confirmation of a complete set of 5 waves and crossing above 5100 Nifty have not come in yet.However, looking at circumstances, chances are high that we have bottomed out.

So, on the assumption that we have bottomed out, checking out whats NEXT?

In the long term counts that I had put forth earlier, there were two options - either we are in wave Y or we are making a flat, in which case we are in wave B.

I am ruling out possibility of wave Y for now: reasons :

*We have retraced around 92% of the distance travelled by wave A at the Nov '11 high of 6338(a Flat corrective retraces more than 80% of wave A).

*The market tends to make a flat correction when the underlying force of the larger trend is strong, as in a structurally strong economy, which has the capacity to grow significantly once the correction is over.

*Lots of elections are due in 2012 as mentioned by Jim Rogers, so money printing would continue this year, in which case possibilty of going down towards the lows after an upside of around a 1000/1500 points on Nifty, seems low.

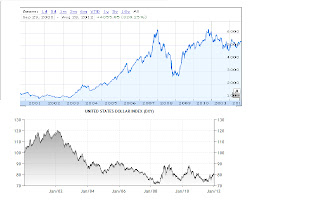

*As per me, as long as USD keeps going up overall(90/95 is where I see it going),world may remain in a risk-on mode....coz it implies that liquidity will remain for sometime.

*The lows were made by an ending diagonal, which is like a terminal triangle, breakouts from which tend to be strong in nature.

*Mind you, that this rally to my mind is more based on liquidity than on fundamentals and any event which makes liquidity collapse(as in money printing to stop) will certainly stop this rally.(SO LOOK OUT FOR THE SIGNALS FROM THE MARKET RATHER THAN ANYTHING ELSE, INCL. WHAT I THINK)

So that leaves us with the other possibility of making a FLAT, and hence, in wave B:

I am assuming we will make a new high, becoz not doing so will make the structure look like that of wave Y discussed earlier.

=>How far can wave B go?

*We have to see wave B in relation to wave A.(Wave A started in Jan 2008 and travelled from 6357 to 2253, but ended at 2539.This implies that wave B began at 2539)

*We also have to see the breakup of wave B,into 3 parts a,b and c (which is what we are in)( a went from 2539 to 6338.5, b went from 6338.5 to 4531 but ended at 4588, and c has mostly begun from 4588.)and their internal relationship.

* Seeing B in relation to A,

If B=A, we can go to 6643(we have already retraced 92% remember)

If B = 1.236 of A we can go to 7612If B = 1.382 of A we can go to 8210(possibility of this is low for now)

B can also exceed 8210, possibility of this too is low, becoz it would lead to a running correction, for which the economy should be very strong, which does not seem to be the case.

So as far as B in relation to A is seen, we can go to 6643 or 7612 regions for now.

*Seeing the internal relationship between wave a and wave c of wave B:

If c=.5of a, we can go to 6488

If c= .618 of a, we can go to 6936

If c= .8 of a, we can go to 7628.So far as wave c(of B) in relation to wave a(of B) is seen,we can go to 6488,6936,7628 regions.

All the above are open possibilities, one cannot predict where exactly the market will go, but it does seem that we will make a new high.Also, I do not see the market going above 7600/7650 region becoz,the fib ratios mentioned in bold above come in that region.

As of now I am not seeing the possibility of going to 8210 or above(but one never knows), as in such a case the wave C(the big one) may not retrace back to the lows of wave A(the big one)which is what happens in most(but not all flat corrections).

There are plenty of excesses in the Indian economy too(bubbles which have built up) which need to be corrected, which would not happen in case of going to 8210 or above,so I do not see that happening..... corrections normally break all bubbles.

Lets see what happens.

Clarification: I am not suggesting an immediate long or short. This is a long term view as in may take 9 months to a year or so to play out, depending on how high we go.